A Strategy for Financing the Nuclear Future

Executive Summary

- For the first time in over a half-century, there is both broad public support and bipartisan eagerness to build nuclear power plants. Policymakers have been taken by surprise by the fact that U.S. electricity consumption is now ramping up after nearly two decades of little to no growth. By 2050, total domestic demand is expected to grow by more than 50% because of the increased power needs of the technology sector from the rapid build-out of energy-intensive data centers and the reshoring of semiconductor manufacturing. There is no prospect for intermittent wind and solar power generation meeting the scale of 24/7 demand, leaving natural gas and nuclear as the main viable options.

- Thus far, renewed interest in nuclear energy has focused mainly on restarting mothballed reactors or pursuing the development of a new class of small reactors, some based on modular designs (i.e., SMRs). But only a small handful of reactors are available in the former category, and the latter remain many years away from achieving proven commercial designs. Meanwhile, there has been little to no interest in building more of the well-established large-scale reactors that are the workhorse of the nuclear industry. A widespread perception is that conventional large reactors are too capital-intensive, too time-consuming to build, and financially risky to undertake. Yet there is no technical ambiguity about the fact that the industry knows how to build conventional nuclear power plants; more than 400 of them are operating around the world, and more than 60 are under construction (none in the U.S.).

- Investor-owned U.S. electric utilities have had a poor track record of adding new reactor capacity on a timely and cost-effective basis because of persistent project cost overruns and construction delays. The last two large-scale U.S. reactors connected to the grid over 2023–24, Units #3 and #4 at Georgia Power Company’s Vogtle Plant, were the costliest to date. Even though much of that cost escalation came from several nonrecurring idiosyncratic factors that would not be applicable going forward, no utility company seems able to get past the Vogtle sticker shock and order a new large-scale nuclear power plant, including Georgia Power, which now has deep experience.

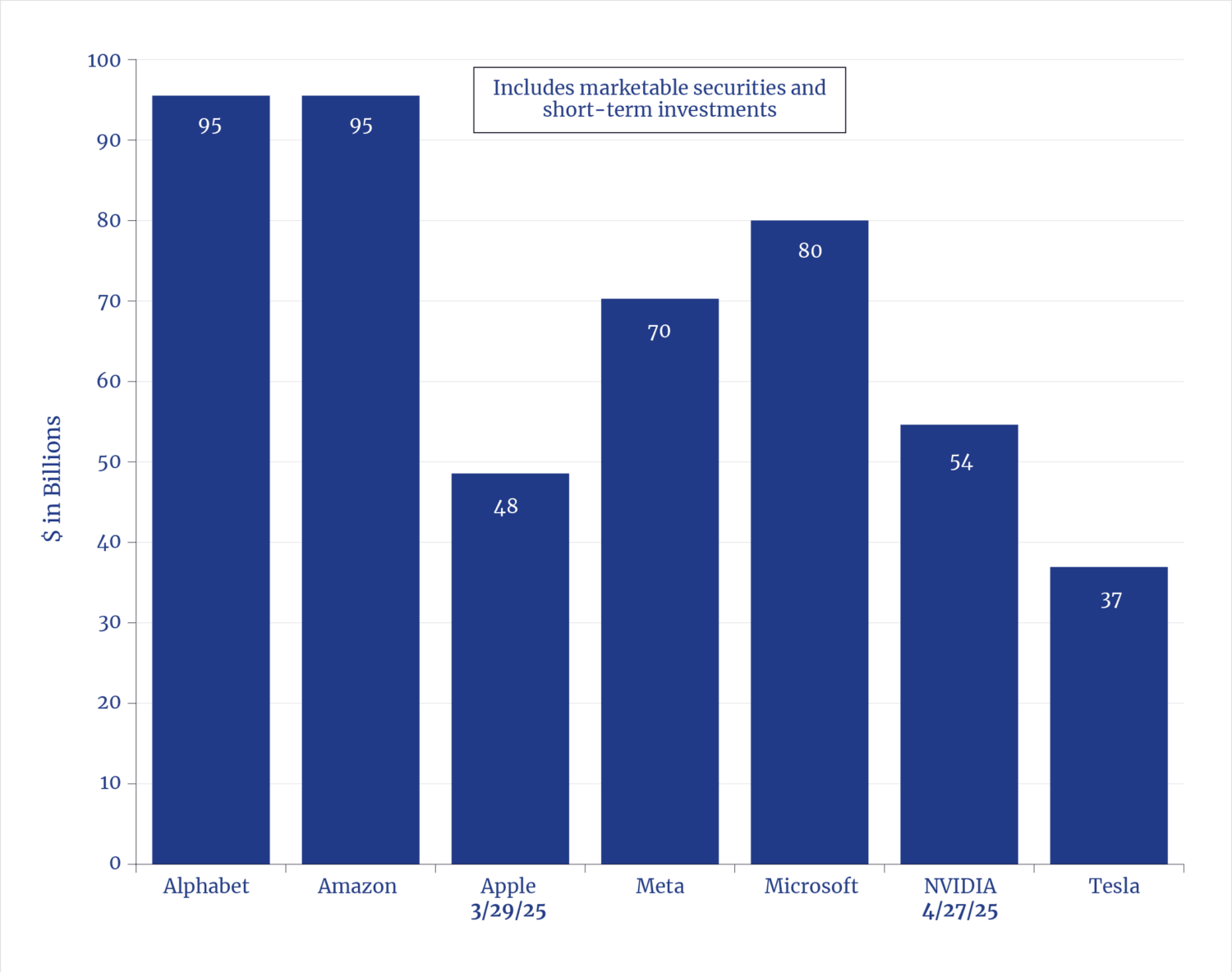

- To break the current logjam to confront the outsize financial, not technical, risks of conventional nuclear construction, a new project financing approach is needed—one that brings in a new class of investors during the construction phase who are better capable of managing the upfront financial and development challenges of a greenfield nuclear project. Large infrastructure private equity firms have experience in the overlapping domains of energy, infrastructure, project delivery, and risk management, along with ample capital resources. Currently, some $1 trillion of infrastructure-related private equity capital is available that could be used to fund greenfield U.S. nuclear projects. The top seven Big Tech companies combined, the “Magnificent Seven,” alone have nearly $0.5 trillion of cash on hand. Utilizing an asset-based project finance model that maximizes lower-cost debt in the capital structure would allow new private equity sponsors to achieve their targeted returns and then sell a completed nuclear plant to a utility operator.

- Attracting private equity capital to kickstart the construction of large-scale nuclear reactors will require a favorable investment backdrop that, in turn, will depend on greater regulatory certainty, especially during the all-important construction phase, something that now appears underway with the recent strong show of support for the nuclear industry by the Trump administration and the Republican-controlled Congress. Confidence in achieving construction in the time frames that have been repeatedly achieved around the world, combined with a project finance model, can allow development of new large nuclear reactors, even without government subsidies. While there is a need for continued government credit support in the form of low-cost loans and loan guarantees (all of which would be repaid upon completion), this should fall away as more commercial lending channels are put into place for nuclear project financing deals. The key will be to demonstrate a first proof of concept; then the U.S. government can step back and allow private financial markets to take over.

Introduction

The United States needs more power. After remaining flat throughout most of the 2000s and 2010s, electricity demand has now begun to ratchet up sharply during the current decade. The main driver has been technological developments in the digital economy—including artificial intelligence (AI), cloud computing, and cryptocurrency mining—and the related build-out of supporting data center infrastructure. Since 2021, the number of data centers operating in the U.S. has more than doubled, to 5,427 currently, with concentrations in Virginia, Texas, and California.1 Data centers are one of the most

energy-intensive building types, consuming 10 to 50 times the energy per floor space of a typical commercial office building.2

Depending on the size of the building footprint and the number of servers housed, small data centers (5,000–20,000 square feet with 500–2,000 servers) can consume 1–5 megawatts of power, while large or hyperscale data centers with tens of thousands of servers over more than a million square feet can use more than 100 megawatts each.3 In 2023, total electricity consumption by data centers amounted to 176 billion kilowatt hours, or 4.4% of aggregate U.S. demand, more than doubling in the five years since 2018. By 2028, data center power demand is currently estimated in the range of 325–580 billion kilowatt-hours or the equivalent of 7%–12% of total forecast U.S. consumption, which would imply a compound annual growth rate of 13%–27% over 2023–28.4 Also feeding the resurgence in U.S. power demand has been the recent reshoring of industrial and manufacturing activity from abroad, as well as the increasing electrification of the domestic economy’s transportation and heating sectors.

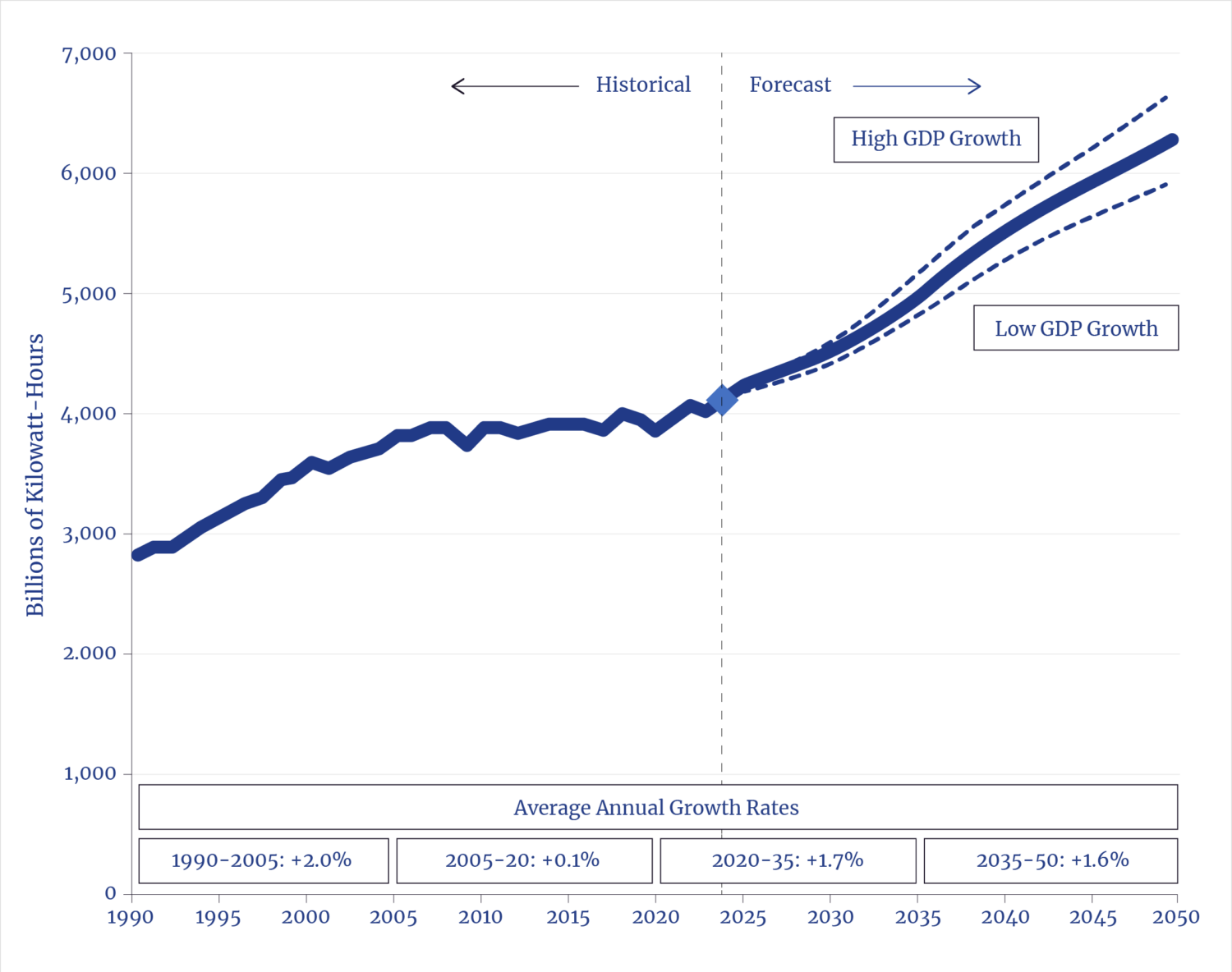

As a result of these economic drivers, U.S. electricity demand is now hitting an inflection point. As seen in

Figure 1, after increasing by an annual average of just 0.1% over 2005–20, power consumption is now reverting to growth rates last seen during the 1990s, another decade marked by rapid technological change. Between 1990 and 2005, annual U.S. electricity demand grew by an average of 2.0%. In its latest biennial Annual Energy Outlook, released this year, the U.S. Energy Information Administration (EIA) is projecting an average annual growth in U.S. electricity demand of 1.7% over 2020–35, and a 53% increase in total demand between 2024 and 2050.5 Under its high economic growth case, the jump in demand would be 63% over 2024–50. Other recent U.S. Department of Energy (DOE) reports have estimated that U.S. electricity demand could potentially double, to roughly 8,000–8,500 billion kilowatt-hours by 2050.6

Figure 1: U.S. Electricity Consumption, 1990–2050

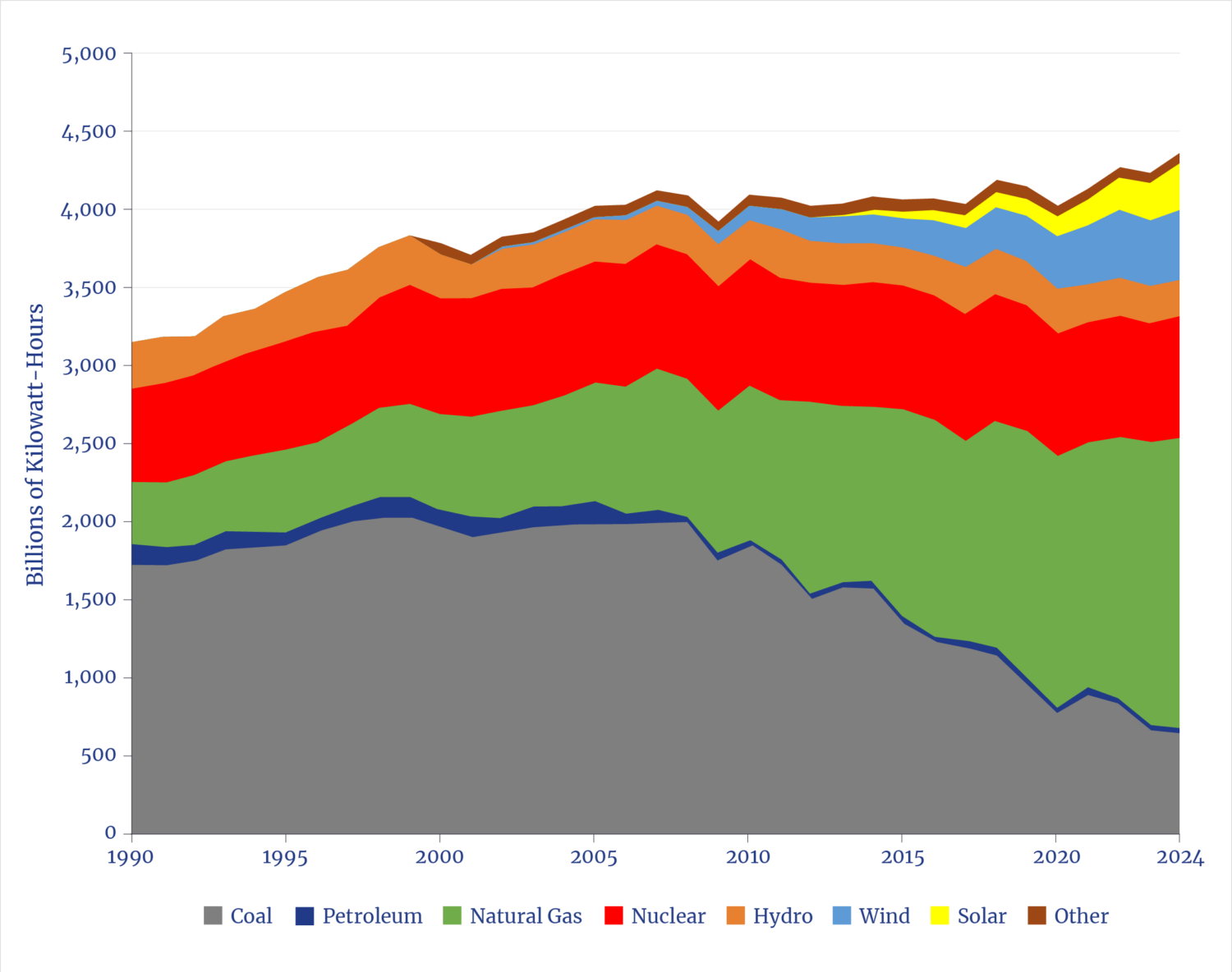

Over the past two decades, anemic power demand growth has largely masked a problematic shift in

the country’s electricity generation mix—away from dispatchable forms of energy such as coal, natural gas, hydroelectric, and nuclear, and increasingly toward intermittent and weather-dependent sources such as wind and solar. As seen in Figure 2, coal-fired power generation has declined sharply on the back of more stringent environmental regulations, dropping from 50.1% of total electricity production in 2004 to 14.9% in 2024. Since most retired coal facilities have been replaced by new natural gas plants up until now, this switch between dispatchable fuels has had a minimal impact on overall grid reliability while also helping reduce emissions due to the smaller carbon footprint of natural gas.

Figure 2: U.S. Electricity Production by Source, 1990–2024

At the same time, wind and solar generation have both steadily increased from 0.4% of the U.S. total in 2004 to 17.2% in 2024 on the back of regulatory mandates and generous state and federal government subsidies.7 Even with weak overall consumption growth, demand response programs (i.e., paying customers to curtail their power usage during peak demand periods) have figured more prominently in the operations of many state and regional grids in recent years to compensate for the variability of wind and solar electricity production. And since the recent abrupt shift in the U.S. generation mix has been mainly driven by regulations rather than economics, the result has been market pricing distortions that have

disproportionately affected the base load generators (both fossil fuel and nuclear) that provide continuous power to the grid, further compounding the underlying problem of a shrinking dispatchable power base.

Based on the current trajectory, dispatchable fuel sources over the next decade—including all remaining

coal plants plus aging members of the U.S. natural gas and nuclear power fleet—are slated to be replaced

with intermittent wind and solar generation. This will seriously undermine American grid reliability and lead to inevitable power shortfalls, given the anticipated rapid growth in U.S. electricity demand.

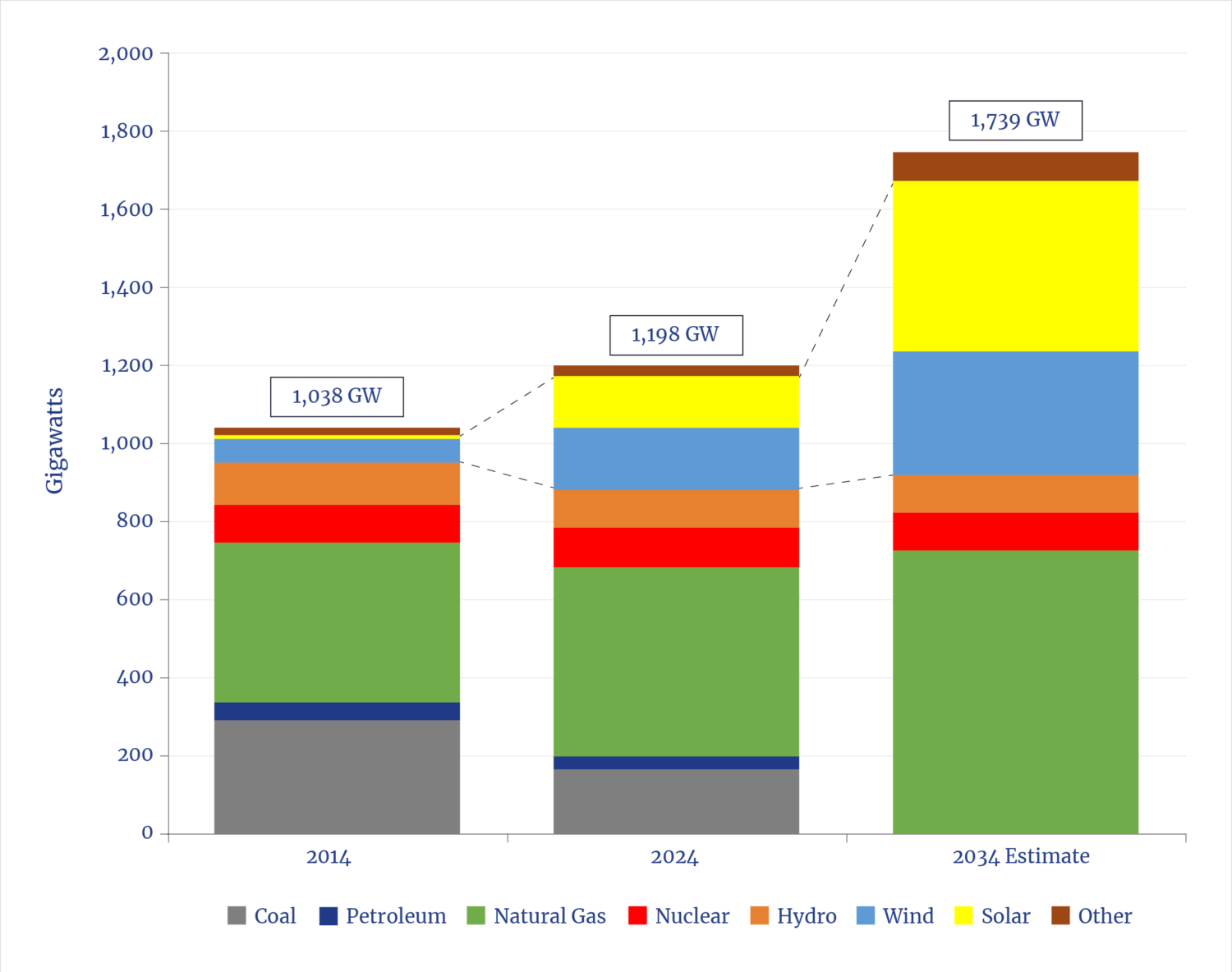

Figure 3 highlights how almost all the currently planned increase in U.S. electricity generation capacity

between 2024 and 2034 (541 gigawatts, an increase of 45%) will be driven by renewable sources such as wind and solar (augmented by temporary backup battery storage). Based on EIA’s latest long-term base-case forecast, natural gas is expected to fully displace coal within 10 years and account for 41.4% of U.S. generation capacity by 2034, with nuclear and hydroelectric capacity remaining static in nominal terms but declining sharply on a relative basis over the period. Wind and solar generation capacity are projected to increase from 22.9% in 2024 to 43.0% of the U.S. total in 2034.8

Figure 3: U.S. Electric Net Summer Generation Capacity by Source, 2014–34

In its 2024 Long-Term Reliability Assessment report, the North American Electric Reliability Corporation (NERC) noted that most of the North American bulk power system faces “mounting resource adequacy challenges over the next 10 years as surging demand growth continues”9 and conventional sources of dispatchable generation are increasingly replaced by more variable and weather-dependent resources. Conventional generators (including coal, nuclear, natural gas, and hydroelectric plants) can be dispatched when needed to meet demand and provide system inertia, voltage control, frequency response, and dynamic reactive support to ensure stable grid operation. Since renewable resources have limited

or none of these attributes, a growing reliance on wind and solar generation capacity will decrease grid reliability and increase the risk of power outages and system failures, as seen by the recent blackout across Spain, Portugal, and parts of southern France in April 2025.10Because of this accelerating trend toward intermittent generation, NERC has flagged a high or elevated level of risk of potential power shortfalls across more than half of America’s regional electricity markets over 2025–29.11 DOE issued its own resource adequacy report for the U.S. power grid in July 2025, which highlighted many of the same reliability and security issues.12

To meet projected U.S. electricity demand growth while ensuring grid stability, the current flood of new

solar and wind generation projects will need to be stemmed. A reliable U.S. power grid requires a balanced

mix of dispatchable energy sources, including coal, natural gas, hydroelectric, and nuclear. Such diversity

of generation capacity will help mitigate the risk of commodity price fluctuations and supply-chain disruptions and help ensure the lowest average cost of electricity for the American consumer over the long term. Notably, the present industry view of natural gas as the dispatchable fuel of choice—while perhaps defensible in terms of current construction costs and plant delivery times—exposes U.S. electricity prices to natural gas price volatility down the road. Such volatility is likely to increase due to ramping U.S. liquefied natural gas (LNG) exports and the growing linkages between U.S. and international natural gas markets.

This risk was clearly highlighted when Henry Hub natural gas prices spiked to an average of $6.45 per million British thermal units in 2022 (the highest in the post-shale period) following the outbreak of the

Russia–Ukraine war as European natural gas customers scrambled to replace Russian pipeline gas imports with U.S. LNG.13 An exclusive dependence on natural gas will also expose the electricity grid to delays in bringing on new natural gas pipelines to keep up with demand from the power sector. An all-of-the-above approach to building out the country’s conventional generation capacity is also warranted by the fact that all these dispatchable categories are roughly the same vintage (approximately 40–60 years old). Over the next decade, many coal, natural gas, hydroelectric, and nuclear plants will be synchronously aging out of the U.S. generator fleet.14 As such, new conventional capacity must be added across the board, not only to meet projected load growth but also to replace retiring units.

Nonetheless, there are no current industry plans to significantly increase dispatchable U.S. generation capacity away from natural gas, the most favored conventional fuel at this moment. While coal and

hydroelectric power face their own unique set of challenges to expanding their existing asset base—coal

due to its carbon emissions, hydroelectric due to the size of its geographic footprint—this report will focus on the current barriers and impediments to constructing new large-scale nuclear reactors in the U.S.

In recent months, there has been a renewed focus on the benefits of reliable nuclear power. Previously

shuttered nuclear reactors have been reactivated, 15 and several small modular reactor (SMR) projects

have been started up.16 The One Big Beautiful Bill Act (OBBBA) signed into law by President Trump in July

2025 contained a number of pro-nuclear provisions, including the continuation of investment and production tax credits for newly constructed nuclear reactors through 2033.17 Despite such positive momentum, there is minimal support for building new large (i.e., one gigawatt or more) reactors—the workhorse of the U.S. nuclear industry—due to the widespread view that such capital-intensive construction projects are too expensive, time-consuming, and financially risky. This report argues that a new project-based financing approach anchored by new private equity sponsorship is necessary to help mitigate the perceived development risks of large-scale nuclear reactors and kickstart the next building cycle for the domestic industry.

Arrested Development: A Short History of the U.S. Nuclear Power Industry

The U.S. currently has the largest nuclear power fleet in the world,18 with 94 operating reactors located at 54 sites across 28 states, mostly concentrated in the eastern portion of the country.19 In 2024, the U.S. generated 782 billion kilowatt-hours of nuclear power, which equated to 28.3% of the worldwide total, far ahead of the next four leading commercial nuclear powers: China (445 billion kilowatt-hours, 16.1%, 57 reactors); France (379 billion kilowatt-hours, 13.7%, 57 reactors); Russia (216 billion kilowatt-hours, 7.8%, 36 reactors); and South Korea (189 billion kilowatt-hours, 6.8%, 26 reactors).20

Since 1990, nuclear power has supplied approximately 18%–20% of annual U.S. electricity demand21

despite accounting for a declining share of total generation capacity (8.1% in 2024).22 It has done so thanks to its efficiency and high capacity factors (92.3% in 2024).23 Nuclear power plants are designed to run 24/7 because they require less maintenance and can operate for longer stretches before refueling (i.e., typically every 18–24 months).24 The U.S. nuclear power industry is almost exclusively composed of large-scale light water reactors (67% pressurized water, 33% boiling water), including more than 50 different commercial reactor designs.25 U.S. nuclear reactor unit capacity presently averages 1.0 gigawatts, while the median capacity-weighted age of the operating fleet stood at 42.7 years in 2024,26 which compares with an estimated total operational life for most large-scale models of upward of 80 years.27

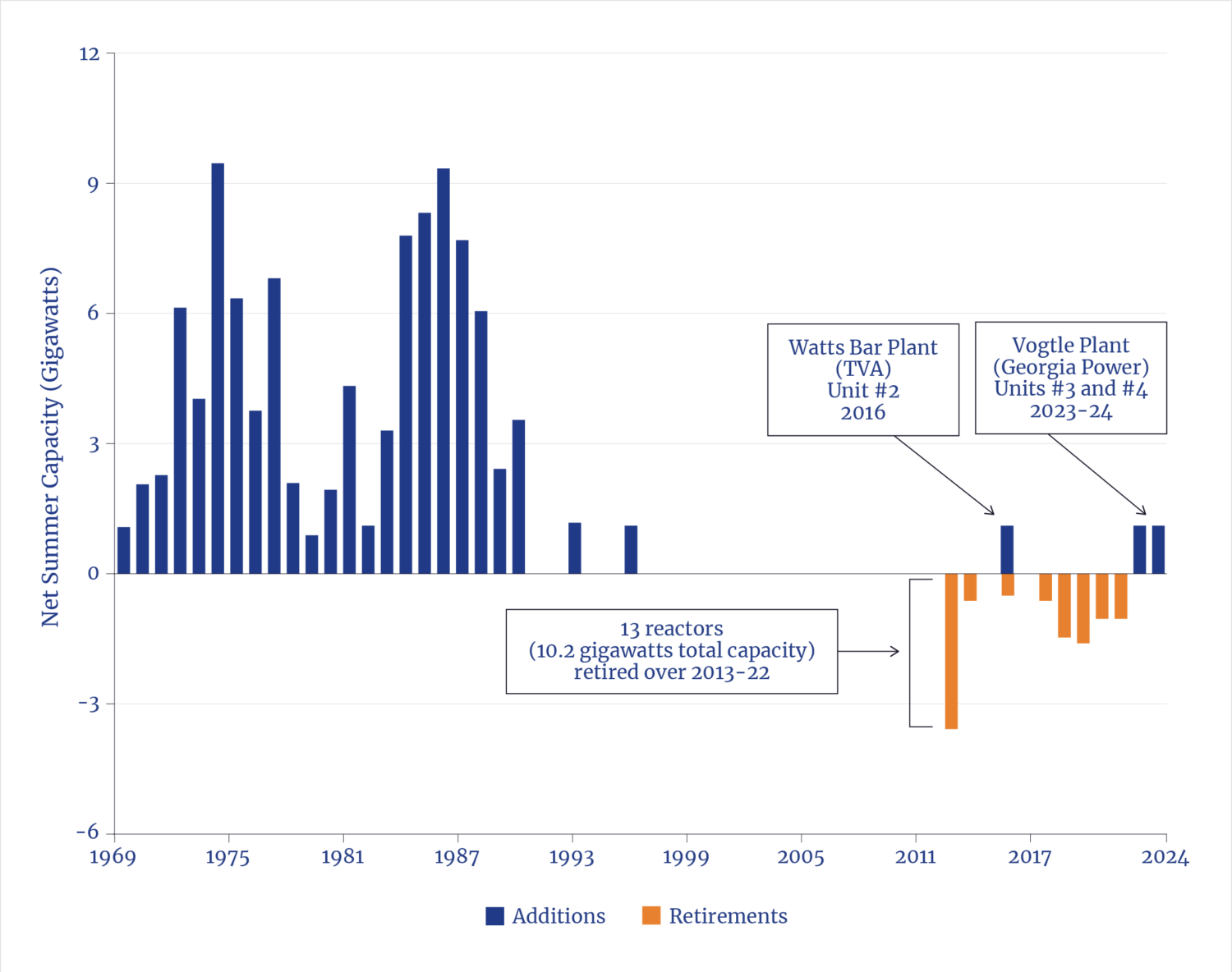

As seen in Figure 4, most of the country’s current nuclear capacity was added during nuclear power’s heyday in the 1970s and 1980s. Between 1970 and 1992, 102 reactors with an aggregate capacity of 102,345 megawatts were completed.28 That said, following the 1979 accident at Unit #2 of the Three Mile Island (TMI) Plant in Londonderry, Pennsylvania,29 industry orders were canceled across the board, and there were no new construction starts after 1977. Between 1977 and 1989, 40 new-build projects were abandoned.30 After completing those remaining projects in the pipeline, the nuclear industry effectively went dormant for nearly two decades.

Figure 4: U.S. Nuclear Power Capacity Additions and Retirements, 1969–2024

During the 1990s and 2000s, the federal government attempted to resuscitate the nuclear industry

and restart construction by simplifying the nuclear licensing process31 and providing financial incentives

and additional support through the Energy Policy Act of 2005.32 While this government effort led to the filing of 31 new combined construction and operating license (COL) applications between 2007 and 2009, most of these projects never moved forward or were ultimately canceled (some during the construction phase).33

The net result of this “false spring” phase for the industry was that only three new units (with an

aggregate summer capacity of 3,350 megawatts) were completed and connected to the grid. Of these, one was a previously abandoned Tennessee Valley Authority (TVA) construction project from 1996 that was restarted and finally completed in 2016 (Watts Bar Unit #2), nearly 43 years after construction first started in 1973.34 The other two were greenfield reactor builds by Georgia Power Company at its existing Alvin W. Vogtle nuclear plant site near Waynesboro, Georgia (Units #3 and #4),35 both of which started construction in 2013.36 Notably, over 2013–22, 13 large-scale reactors with a total capacity of 10,176 megawatts were shut down prematurely because of market pricing and economic considerations, as opposed to issues of obsolescence, resulting in a net loss in nuclear capacity over the past decade.37

Large-scale nuclear reactors are one of the most capital-intensive energy infrastructure asset classes. Typically, construction costs (including direct costs for materials, equipment, and labor, plus indirect costs for engineering services, construction management, and administrative overhead) represent the lion’s share of the total cost of nuclear projects. Given the long (and often open-ended) construction periods involved, financing costs for the investment capital used (both debt and equity) can significantly add to the building cost, increasing the sensitivity of nuclear builds to overall interest rates.

While higher plant construction costs are offset by very low and stable fuel and other operating costs over the reactor’s long useful life, roughly 80%–85% of the total levelized cost of energy (LCOE) for utility-scale nuclear projects is composed of up-front investment. Because such capital costs are largely fixed, nuclear plants tend to be operated continuously to supply baseload electricity to the power grid. By comparison, capital costs represent approximately 40%–60% of the current LCOE for a combined-cycle natural gas plant, with variable fuel costs averaging 25%–50% over a much shorter operating life.38

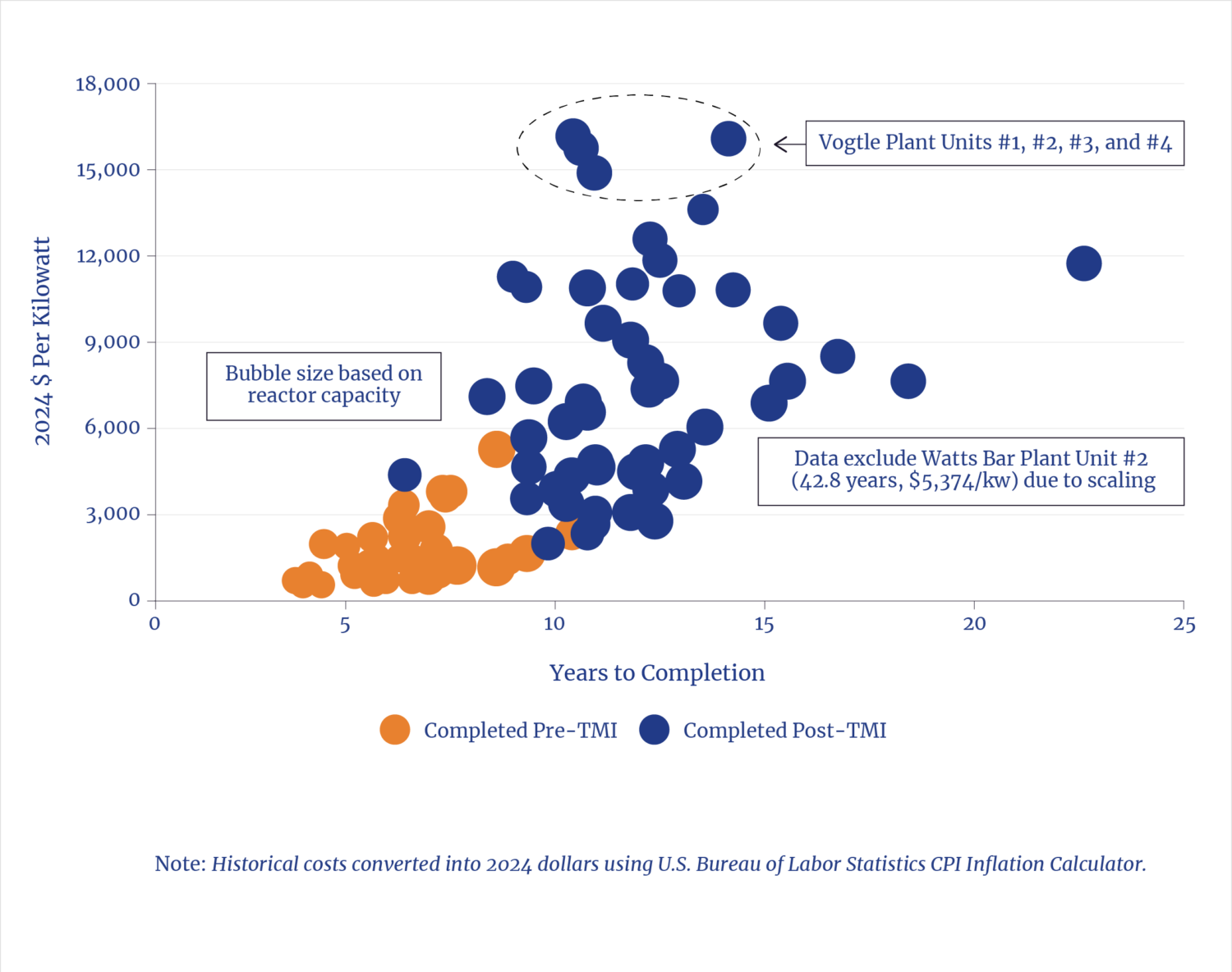

Figure 5 shows the trend in construction costs (including financing) and completion times for the 94

nuclear reactors currently operating in the country. Along with public opinion, the TMI accident in 1979 also fundamentally changed the regulation of the industry, leading to new safety requirements that significantly increased construction costs and lengthened completion times for building projects. The cost of materials, equipment, labor, and design engineering all went up, while the turnaround time for regulatory approvals, including licensing and back-fit requirements, slowed markedly.

Figure 5: U.S. Nuclear Construction Costs and Completion Times, 1969–2024

Even though U.S. consumer price inflation and general interest rates dropped sharply between the 1970s and the 1980s,39 the delivered cost for a new nuclear reactor more than doubled while taking twice as long to finish. During this period of arrested industry development, few synergies and cost savings were realized between the first and successive units added at most nuclear plant sites. As Figure 5 illustrates, the 43 reactors completed prior to 1979 took a median 6.0 years to complete, at an average cost of $1,897 per kilowatt in 2024 inflation-adjusted dollars. The 51 reactors completed since 1979 (including the three commissioned over 2016–24) took a median 12.2 years to complete, at an average capital cost of $7,627 per kilowatt. Differential reactor size does not explain this variance since the units completed pre-TMI

had an average capacity of 886 megawatts, while those completed post-TMI had an average capacity of 1,154megawatts.40

Despite the hoped-for renaissance from the Energy Policy Act of 2005, the industry trend of cost overruns

and construction delays persists to this day. Critics point to the all-in price tag for the two new nuclear reactors just added at the Vogtle Plant—roughly $16,000 per kilowatt each—as proof of the prohibitive cost of adding new nuclear capacity. Such a perception overlooks the idiosyncratic factors and extenuating circumstances that combined to raise the total cost of these units, none of which should be applicable to other construction projects going forward. These are discussed in more detail below. Indeed, even with such nonrecurring expense added on, the total cost of Vogtle Units #3 and #4 was not meaningfully

higher than the inflation-adjusted cost of Units #1 and #2, both of which were completed during the late

1980s for $11,000–$15,000 per kilowatt in 2024 dollars. Moreover, 10 other nuclear reactors have been built to date for over $10,000 per kilowatt, all of which continue to operate economically to this day.41

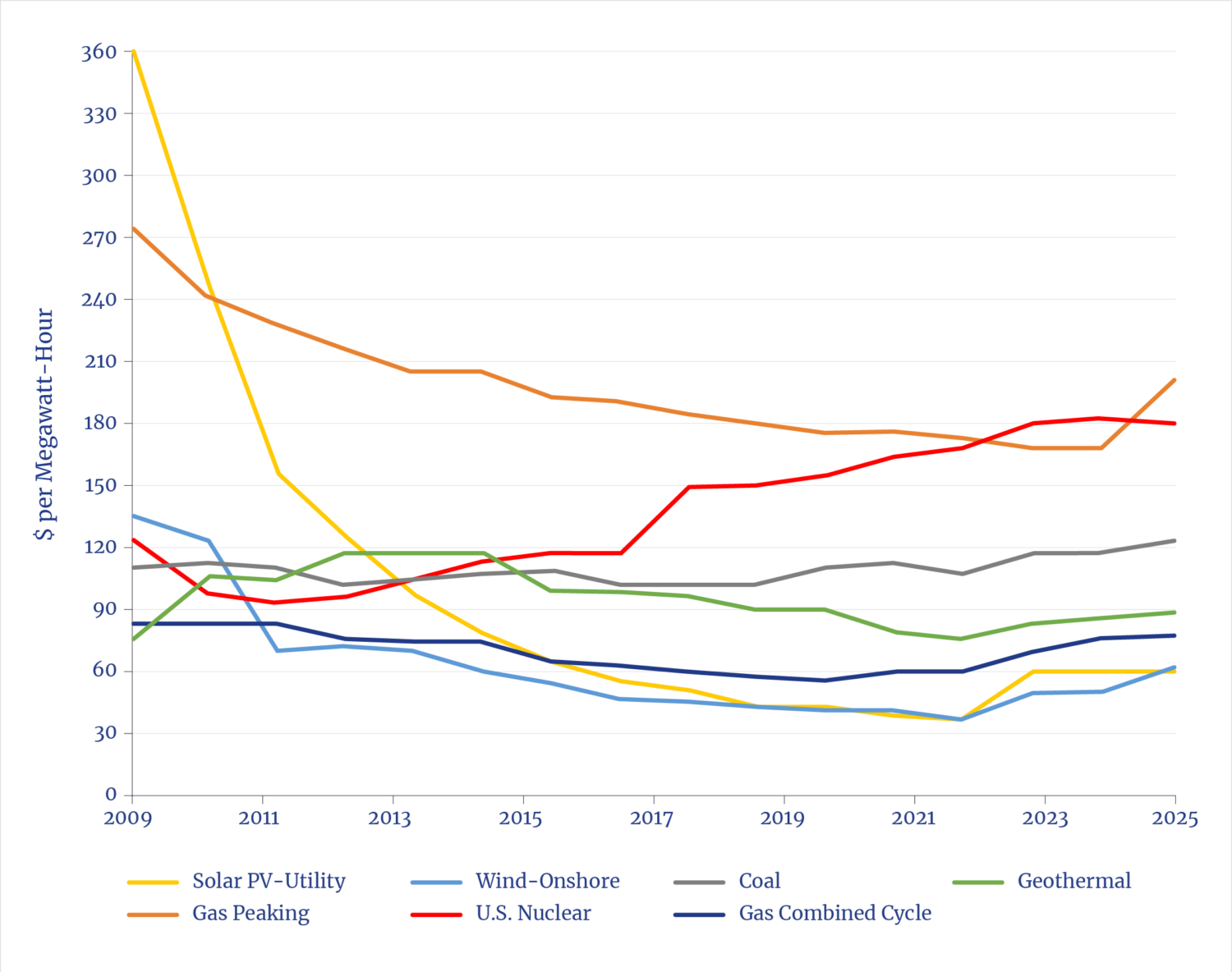

As noted above, merely looking at the disproportionate up-front construction costs of nuclear power

skews the economic analysis. Using an LCOE approach that factors in the low production costs and very long operational lives for most reactors shows that nuclear power remains competitive on an all-in basis with other forms of dispatchable energy, including natural gas, as seen in Figure 6. Also included in the comparison are LCOEs for utility-scale solar and wind projects, even though these numbers are understated since they do not include the cost of backup firming for intermittency. Controlling for the project-specific issues encountered at Vogtle Units #3 and #4 removes much of the recent uptick in the calculated LCOE of nuclear over the past decade. Further reductions are possible by adjusting the underlying assumptions used, particularly the financing cost and funding approach utilized, discussed in more detail below.

Figure 6: Average Levelized Cost of Energy (LCOE) for Utility-Scale Technologies, 2009–25

While combined-cycle natural gas plants will still likely have the lowest comparative LCOE, opting for the

cheapest LCOE alternative at any point in time is not a sound way to ensure a stable, reliable, and low-cost grid, which depends, importantly, on a diversified pool of dispatchable fuels. This is the main argument that has been used to justify building more wind and solar generation capacity in recent years, despite the negative implications for overall electric grid reliability. Utility companies, regulators, and policymakers need to move past a myopic focus on current construction costs, which fluctuate and are only one piece of the puzzle when making longer term grid capacity decisions.

First Mover Disadvantage: A Forensic Analysis of Vogtle Units #3 and #4

As the first nuclear build in the U.S. in more than a generation, Vogtle represented a test case for the industry, although the learning experience was marred by a series of unfortunate decisions and cascading events. Vogtle was the first to use Generation III+ nuclear technology—specifically Westinghouse’s two- loop AP1000 reactor model. Compared with the Westinghouse 4-loop PWR model used for Units #1 and #2, the AP1000 was designed to be simpler, with 50% fewer safety-related valves, 80% less piping, 85% less control cable, 35% fewer pumps, 45% less seismic building volume, and a fully passive cooling system that requires no operator intervention or external power to remove heat for up to 72 hours.42 With fewer components and construction materials (mainly concrete and steel), the AP1000 also had a smaller physical footprint and took fewer work hours to build, partly due to its modular construction approach and use of prefabricated units installed on-site.43

However, the initial design of the AP1000 had significant constructability issues. For example, the compacted footprint forced systems and components to be closer together, making them difficult or impossible to install and requiring frequent design changes. The reactor’s prefabricated modules were often out of specification and had to be reworked, which was more difficult to do on-site. The reactor coolant pumps utilized by the AP1000 design had to be recalled four years into the project and required two years to fix.

Compounding matters, the new one-step combined COL used for Vogtle meant that every design change

order required a new U.S. Nuclear Regulatory Commission (NRC) rulemaking decision through a license

amendment request, which made the approval process much slower and more cumbersome. Moreover, since Vogtle was the first nuclear power plant to be built since the 9/11 terrorist attacks, arbitrary safety-driven regulatory changes (which had dogged the industry in the post-TMI period) were also a factor. In 2009, seven years after the company had originally applied for approval of its design, Westinghouse was forced to modify the containment building for its AP1000 reactor to ensure that the structure could withstand a commercial aircraft strike. This delayed the original start of construction for over three years.44 In March 2011, the tsunami-related Fukushima Daiichi nuclear power plant disaster resulted

in a further several-month delay as revisions were made to the design control document.45

Not having a final set of detailed engineering plans before approving the capital investment and proceeding

with construction led to continued cost increases over the life of the project. This problem was further exacerbated by the choice of Westinghouse as the engineering, procurement, and construction (EPC) contractor. Westinghouse had extensive experience in designing nuclear reactors dating back more than 60 years—nearly half the 439 nuclear reactors currently operating in the world use Westinghouse technology46—but Vogtle was the first project where the company had also served as an EPC contractor and actually built one. Moreover, the two 1,117-gigawatt units at Vogtle were not the only large-scale

units then being built for the first time by Westinghouse; the company was also simultaneously constructing two same-size 1,100-gigawatt AP1000 reactors roughly 125 miles away at the Virgil C. Summer nuclear generating station near Jenkinsville, South Carolina.

Having a multiple AP1000 reactor order book was necessary to rebuild parts and equipment supply chains,

scale up manufacturing capability, and attract engineering staff and construction workers. But Westinghouse’s dual role as EPC contractor meant that any cost overruns on the identical reactors were multiplied fourfold, placing a financial—as well as an operating—strain on the company, due to the substantially fixed price agreements used for all four units.47

In 2017, when construction costs were revised up by more than 60% for both the Vogtle and Summer projects and the completion timetable was pushed back by five to six years, Westinghouse was forced to file for Chapter 11 bankruptcy protection.48 Since Westinghouse’s EPC contracts included a parent company guarantee, Toshiba Corporation—which bought Westinghouse in 2006— subsequently agreed to pay $3.7 billion and $2.2 billion, respectively, to the Vogtle and Summer project sponsors to settle all bankruptcy claims.49

Nonetheless, because of the cost increases and construction delays, the Summer project—which was jointly owned by South Carolina Electric & Gas Company (55%) and South Carolina Public Service Authority (45%)—was abandoned after $9.0 billion of sunk capital costs.50 Since Vogtle was sponsored by a more diverse and financially stronger group of power companies— anchored by 45% owner and operator Georgia Power— the decision was made to complete these two new units despite the budget and timing setbacks.51 That said, the governance structure for the Vogtle consortium— specifically, the decision-making veto enjoyed by each equity owner—proved problematic when additional cost increases and delays due to the economic disruption from the COVID-19 pandemic needed to be approved over the next six to seven years.52

The problems encountered with Vogtle highlighted the loss of institutional knowledge across the entire

nuclear industry since the late 1980s, with many of the mistakes of the past repeating themselves. While

technology risk was unavoidable given the need for a new, modern generation of nuclear reactors, better

project planning would have caught the AP1000’s design flaws and constructability issues earlier. All the building contractors involved with the project should have been more experienced, less stretched operationally, and better equipped to deal with contingencies, with more flexible contracts used to align economic interests and avoid legal disputes. Given the inaugural nature of this nuclear construction project, regulators should have provided more oversight and guidance while retaining some historical perspective on overreacting to safety concerns. In particular, NRC should have anticipated construction change orders—since this has been the U.S. industry norm since the 1960s—and figured out a work-around for the rigid revision approval process unintentionally created by combined COLs. For the utility sponsors, the quality of investment due diligence was poor and not at all commensurate with the size of the capital commitment involved. This was owing, perhaps, to the regulatory cover given through early rate-base approval for the construction project.53

All-in, Vogtle Units #3 and #4 were completed for a total cost of $34.9 billion, including $3.7 billion in contract breakage payments by Toshiba and an estimated $7.0 billion in financing costs. The two-unit project came in $20.6 billion, or roughly 150%, over the original budget of $14.3 billion (including financing) and took 10–11 years to construct, double the initial five-year estimate. Including early-stage planning and design work, the entire process took over 15 years from start to finish.54

Rather than view Vogtle as another nuclear failure because of its unit capital cost of $16,000 per kilowatt,

the industry needs to appreciate how this first-of-a-kind U.S. project has now de-risked the AP1000 technology from a building perspective. Most of the problems and delays that increased the overall cost of Vogtle were nonrecurring in nature (particularly COVID-19). All the Vogtle design change orders (which included 197 and 194 license amendments for Units #3 and #4, respectively)55 have now been codified as NRC rulemaking. The next AP1000 build will have final detailed engineering plans to start, eliminating much of the up-front design work. Better contractor choices and contract structures should help avoid a repeat of the highly disruptive Westinghouse bankruptcy, which occurred at the worst possible point in mid-construction. Cutting the project completion time from approximately 10 to five years will reduce

both construction costs (particularly labor) and overall financing expense, the latter roughly linearly, given the time value of money.

Even though Vogtle provides a blueprint for how the next AP1000 reactor can be built on a timelier and more economic basis, the U.S. nuclear industry can’t seem to get past the sticker shock of the Vogtle headline number, $16,000 per kilowatt. There has been renewed interest in nuclear power of late; but as previously mentioned, the focus has been mainly on restarting mothballed large-scale reactors or building new SMR designs. Notably, no operating nuclear SMR has yet been built in the U.S., so going this smaller route presents both technology and constructability risks. It remains to be seen whether the all-in delivered cost per kilowatt for SMRs will come in lower than that for large reactors, with some industry

analysis indicating the exact opposite.56 Moreover, SMRs are a small fraction of the size of conventional nuclear reactors, typically 300 megawatts or smaller, and would take much longer to move the needle in terms of total generation capacity.

It is important that the U.S. nuclear industry get back on the horse and build another AP1000 reactor to

finally realize the synergies and economies of scale that come with standardization and repetition. To this point, Georgia Power has reported efficiency gains from Unit 3 to Unit #4 in terms of construction and commissioning, indicative of the beginnings of a learning process for the company and the industry. Based on company comments, Unit #4 was roughly 30% more efficient and 20% cheaper to build than Unit #3, with key testing milestones being completed 40%–80% faster and engineering service requests being cut in half.57 Since being placed into commercial operation, both new Vogtle reactors have run at 95%–100% capacity factors,58 well above the nuclear industry average of 92%–93% over 2023–24.59 In 2024, Units #3 and #4 won POWER magazine’s “Plant of the Year” award.60

Nevertheless, as of this writing, there are no committed orders or signed contracts for building another AP1000 reactor in this country. Most worryingly, not even Vogtle’s sponsor, Georgia Power, has any plans

to increase its nuclear generating capacity at this point.61

The Nuclear Project Finance Option

Because of the significant financial risks involved, no investor-owned U.S. electric utility is now willing to

proceed with a large-scale nuclear construction project. This is problematic, given that these companies are the operators and owners of the current fleet and the traditional sponsors of new capacity. Most reactors

built in the 1970s and 1980s were financed in regulated energy markets and on utility balance sheets, largely with corporate debt whose issuance was approved for rate-base purposes. Such regulatory certainty helped temper the financial risks associated with cost overruns and delays encountered during the construction period when building a new nuclear reactor. Widespread deregulation of markets, however, has altered the risk profile related to investing in new nuclear capacity because electricity prices are less predictable. As regulatory support for the industry has diminished since the 1980s, the average credit quality and financial strength of most electric utilities have also declined, while corporate management teams have grown more risk-averse, particularly when it comes to capital spending programs for large-scale greenfield projects such as nuclear.62

For most utility decision-makers, the main takeaway from Vogtle and Summer would seem to be that

greenlighting a similar AP1000 construction project would only expose their companies to open-ended

financial risk while creating personal career downside for themselves. While the two Vogtle units were ultimately completed, the project’s financial problems resulted in a downgrade of Georgia Power’s credit ratings in 2018,63 which led to an increase in the company’s overall corporate borrowing costs. Georgia state regulators disallowed approximately $2.6 billion of final project cost overruns, which had to be shouldered by the shareholders of the utility’s parent company, Southern Company.64 The balance-sheet pressure from Vogtle also precipitated the 2019 sale of Southern’s wholly owned Gulf Power Company subsidiary to help shore up its consolidated finances.65

For Summer, the financial fallout was even worse, despite construction being canceled halfway through

in 2017. SCANA Corporation, the holding company for South Carolina Electric & Gas Company, Summer’s 55% owner, was so weakened by the failed project that it was forced to sell itself to Virginia-based Dominion Energy, Inc. in 2018.66 Four corporate executives (including SCANA’s CEO) were convicted of misleading the public and regulators about the problems at Summer, and sentenced to prison time.67 SCANA and its utility subsidiary were also hit with litigation brought by the U.S. Securities and Exchange Commission (SEC)68 and a private securities class action lawsuit,69 both of which the company was compelled to settle. The president and CEO of Summer’s 45% minority partner, the state-owned South Carolina Public Service Authority, stepped down shortly after the project was abandoned.70 South Carolina electricity customers will be paying for the failed Summer project through their monthly utility bills until 2032.71

To break the current logjam caused by risk-averse utility sponsors no longer willing or able to confront the

outsize front-loaded risks of building new reactors, a new nuclear financing model is needed—one that replaces the on-balance-sheet method used by utilities until now. This model will incorporate an asset-based project financing approach that attracts a new class of day-one investors more capable of managing the up-front financial and development risks of greenfield construction. Project finance schemes have been around since the late 19th century and have been used to finance a variety of capital-intensive infrastructure assets, including large oil and gas development fields, commodity resource mines, commercial real-estate complexes, bridges, highways and tunnels, sports stadiums, and independent power plants. To date, they have not been utilized for nuclear power plants, mainly because an alternative regulator-supported financing option was available. Moreover, many nuclear projects failed to make it past the construction phase due to changing safety regulations.

At its core, project finance is a tool of risk management. It is basically a means of spreading all the attendant risks of a long-lived infrastructure asset over a diverse group of counterparties with the requisite risk tolerance and management skills. With large-scale nuclear power plants, the risk profile of the asset class changes markedly once the project moves from the construction phase to the operating phase, the latter of which can average 75 years or longer for current models. Electric utilities have a proven track record of operating nuclear power plants safely over the long term. This business activity aligns with the industry’s core competencies and an overall risk profile that targets a regulator-approved return on equity

in the 8%–10% range.72 The same cannot be said for building nuclear power plants on budget and on time, a goal that has consistently eluded the U.S. utility industry over the past 50 years. Besides being beyond the skill set of most utility companies, the almost speculative nature of nuclear construction is more consistent with the 20% or higher returns typically targeted by private equity investors.

A project financing approach would help correct for this fundamental mismatch by segmenting a nuclear

power project into its two discrete risk phases and then marrying each with the appropriate sponsor and capital. During the higher-risk construction phase, infrastructure private equity funds could be brought in to ensure that projects are completed on time and on budget before transferring the operation of the new asset to a utility company, along with the equity stake. The leading infrastructure investment firms have experience in the overlapping domains of energy, infrastructure, project delivery, and risk management, along with ample financial resources and a track record of successful growth-oriented and value-added investing.

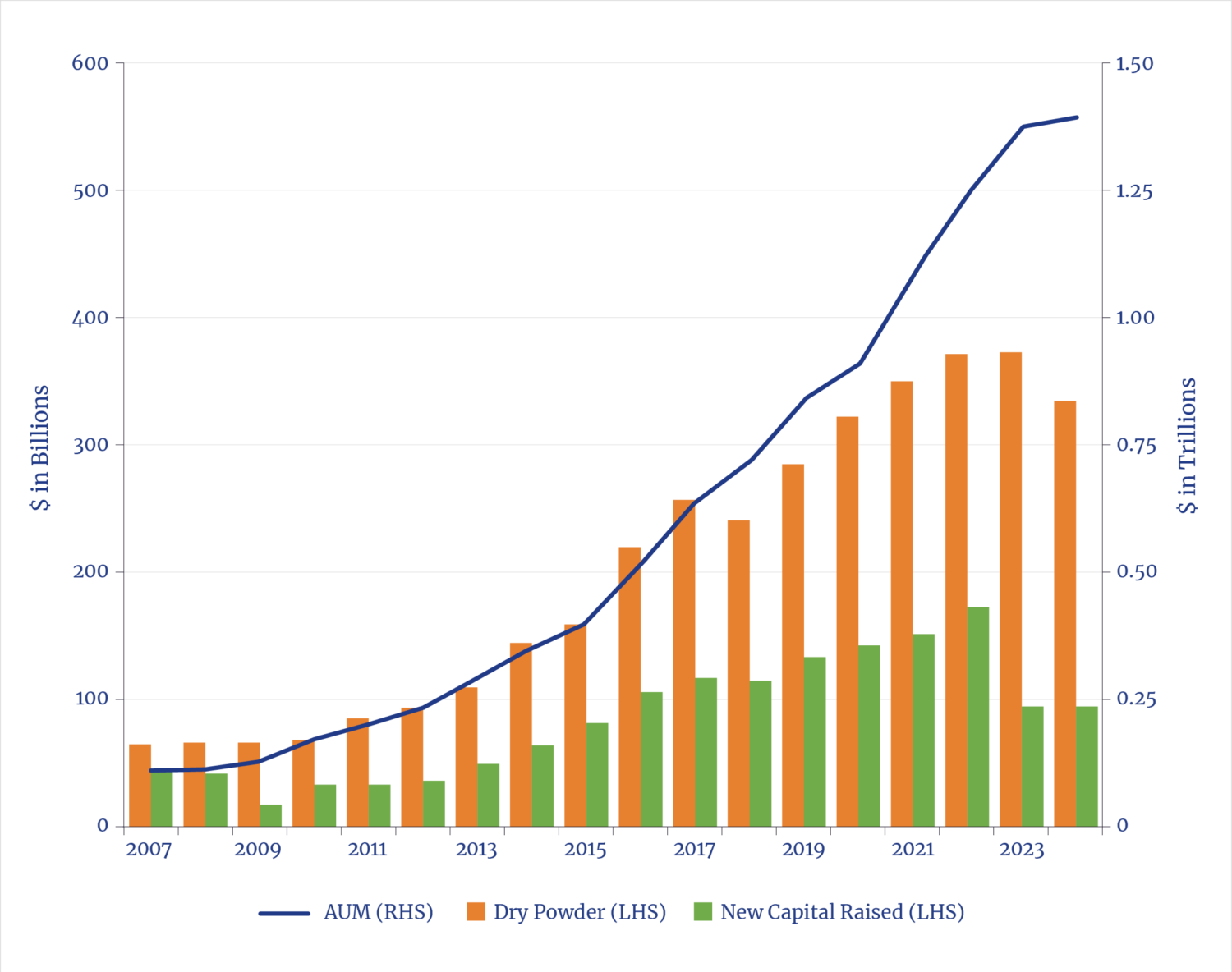

As seen in Figure 7, between 2007 and 2024, the assets under management (AUM) for infrastructure

investment-fund strategies jumped from approximately $98 billion to $1.4 trillion. While stalling somewhat after the Federal Reserve Bank reset interest rates in 2022, the Boston Consulting Group is projecting a resurgence of infrastructure AUM growth to $2.1 trillion by 2028.73 Of the $1.2 trillion of new capital raised over the past decade, there was still an estimated $335 billion of infrastructure dry powder (i.e., fund capital that had been raised and committed but not yet invested) sitting on the sidelines, ready to be deployed as of December 2024. Of this total, roughly two-thirds was focused on higher-return, noncore infrastructure investments as more fund managers move out the risk curve and target different points in the infrastructure life cycle and financing capital structures. Historically, less capital has been available for

greenfield infrastructure projects than for brownfield and existing assets; but this dynamic is changing as fund managers diversify away from lower-return core strategies. In terms of geographic and sector focus, the lion’s share of infrastructure dry powder is available for North American projects related to the broad energy and climate transition space, with zero-emissions U.S. nuclear power ticking all three strategy boxes.74

Figure 7: Global Infrastructure Private Investment Fund Statistics, 2007–24

Large infrastructure players such as Brookfield Asset Management, BlackRock’s Global Infrastructure

Partners, KKR Infrastructure, Macquarie Asset Management, Stonepeak, and Blackstone Infrastructure all

have greenfield expertise and established track records demonstrating their ability to successfully execute new large infrastructure assets such as LNG export plants, crude oil pipelines, airport and marine terminals, and data and other storage facilities. While not active thus far in large-scale nuclear power, such greenfield experience is fungible and transferable, given the networks of operating teams, technical experts, and development companies that these fund managers can draw upon.

With fewer attractive investment opportunities available in the OECD public-private partnership (P3)

transportation sector and emerging-market countries in general, this may prompt a second look at domestic nuclear power by the leading infrastructure investment firms. In recent years, there has been no shortage of capital available for greenfield investments in wind and solar power capacity, some or all of which could be redirected toward nuclear power, based on the recent weakening of U.S. government support for renewable energy. Data centers have also been attracting large amounts of infrastructure fund capital for new construction, a portion of which could be logically reallocated to building new nuclear power capacity that will be needed to provide a reliable source of electricity for these energy-intensive buildings.

All the incumbent infrastructure fund managers have critical mass in terms of capital resources and the

ability to make the large up-front equity investment required for large-scale nuclear construction. Moreover, these managers can easily syndicate out the total equity commitment by calling on co-investment capacity from the limited partners of their funds. In 2013–24, the top 20 infrastructure asset managers raised an aggregate $113 billion for co-investment funds.75 A significant amount of supplementary capital is also available from third parties such as technology companies, many of which

are now focused on using reliable nuclear power for their 24/7 data center needs.

As an added benefit, the carbon-free nature of nuclear generation aligns well with the stated public climate

goals of these businesses. In September 2024, Microsoft announced the signing of a 20-year power purchase agreement (PPA) with Constellation Energy to help restart Unit #1 at the TMI plant, which had been shuttered in 2019.76 In October 2024, Amazon signed three off-take agreements to support the development of several SMR projects across the country.77 Over the past year, Google has signed similar agreements with two SMR developers, Kairos Power and Elementl Power—in the latter case, also providing early-stage capital to help advance the targeted projects.78 In June 2025, Meta, the parent company of

Facebook, announced that it had signed a 20-year PPA with Constellation for the output from its Clinton nuclear power station in Illinois to help forestall the premature closure of the 38-year-old plant.79 Notably, Amazon, Google, and Meta all signed a Large Energy Users Pledge with the World Nuclear Association in March 2025 in support of the goal of tripling global nuclear capacity by 205080—a goal that will be achieved only if new U.S. large-scale capacity is part of the equation.

Given their recent show of support for nuclear power, it would be perfectly consistent and complementary for these same technology companies to also invest in new large-scale projects to help harden the American grid. The technology risk would be much lower compared with SMR models, none of which have been built economically yet at a commercial scale. As seen in Figure 8, the technology industry is currently flush with balance sheet liquidity and sitting on nearly half a trillion dollars of cash. A portion of this cash could be earmarked for investing in greenfield AP1000 projects, given the synergies with the sector’s AI-driven core businesses. As of March 31, 2025, the so-called Magnificent Seven of large-cap technology companies—Alphabet Inc., Amazon.com, Inc., Apple Inc., Meta Platforms, Inc., Microsoft Corporation, NVIDIA Corporation, and Tesla, Inc.—had an aggregate cash position of $479 billion.81

Figure 8: Cash Balances at Leading Technology Companies, March 31, 2025

For infrastructure private equity fund managers undertaking greenfield AP1000 projects, various investment exit strategies could be employed, depending on the location of the new reactor. For new assets being built in regulated state markets (such as Georgia and South Carolina), the ownership of the completed reactor could be sold to an electric utility at a stepped-up valuation, along with the operatorship of the facility. This approach would be similar to the design-build-transfer structures found in the P3 transportation market.

For new nuclear reactors being added to unregulated regional transmission organization (RTO) markets, such as the Pennsylvania-New Jersey-Maryland Interconnection (PJM) in the Mid-Atlantic and the Midcontinent Independent System Operator (MISO) in the upper Midwest, where competitive bidding is used to determine economic dispatch and wholesale rates, a nuclear PPA could be layered on, similar to the recent commercial deals signed by Microsoft (in PJM) and Meta (in MISO). Notably, under the two above-noted PPAs signed with Constellation, neither Microsoft nor Meta’s data centers will be supplied electricity directly from the utility company’s nuclear plants. Rather, Constellation will continue to provide nuclear generation to the regional grid while helping both technology companies to virtually achieve their stated clean electricity goals.

A similar type of PPA could be signed up with large energy users in technology and other industrial sectors

to further bolster the economics of a new nuclear reactor. Given the long-term investment horizons and evergreen fund structures characteristic of most infrastructure firms, there is also no reason that a newly built nuclear power plant would necessarily need to be sold immediately. Under a build-and-hold scenario, the operating license of the reactor could be transferred to an electric utility while the fund retained its equity stake and maximized its options for eventually monetizing its investment.

Regardless of the ultimate monetization event, for an infrastructure private equity fund investing in a

large greenfield nuclear project, achieving the fund’s targeted return will hinge on creating the asset at an

attractive enterprise value. Besides executing during the construction phase (i.e., sticking to the project budget and schedule), the other key economic factor is financial structuring—specifically, limiting the size of the equity check (i.e., the investors’ own money) and maximizing the amount of lower-cost debt in the capital structure.

An important benefit of asset-based project financing is that it allows for a greater reliance on debt, upward

of 80%–90% of total funding needs versus a traditional 50/50 capitalization split for most corporate balance sheets. As previously mentioned, nuclear project economics are very sensitive to interest-rate levels and overall financing costs. Based on an analysis prepared by the OECD’s Nuclear Energy Agency, financing costs can constitute as much as 67% of the total LCOE for large-scale nuclear, with a doubling of the weighted average cost of capital for a project also essentially doubling its calculated LCOE.82 At the same time, a doubling of the duration of construction can roughly double the amount of interest paid, as seen with Vogtle, where financing costs increased from a projected $4.0 billion to $7.0 billion by project completion.83

A highly leveraged project financing approach only works if the average cost of borrowing is kept to a

minimum (i.e., 5% or less). The cheapest source of debt available for greenfield nuclear projects would be direct loans and loan guarantees provided by the DOE’s Loan Programs Office (LPO) for critical energy infrastructure and innovative technologies, including advanced nuclear.84 While OBBBA revised the LPO’s clean energy mandate by removing any lending requirement based on a zero-emissions test,85 large-scale nuclear remains a priority of this White House (see below), and there is every indication that AP1000 projects should continue to qualify for LPO programs. OBBBA also extended the DOE’s LPO authority and funding from 2026 to 2028,86 while U.S. Secretary of Energy Chris Wright has publicly stated his intention to use the DOE’s resources to “advance the rapid deployment of next-generation nuclear technology.”87

Notably, the LPO provided $12.0 billion in loan guarantees to the Vogtle project,88 without which its

above-noted 75% jump in financing costs would have been even higher. State energy financing institutions would be another low-cost debt option, along with concessional credit facilities provided by development agencies to the extent available. While not directly applicable to U.S. nuclear projects, given its developing world focus, the fact that the World Bank recently lifted its global lending prohibition on nuclear power89 should provide a halo effect for other supranational and sovereign credit agencies, as well as private-sector lenders, to do the same. In addition, financial guaranty insurance could be used to lower the cost of other debt in the capital structure. Leading bond insurers such as Assured Guaranty all have infrastructure finance business segments for underwriting large capital-intensive projects on a stand-alone basis.90 Upon completion of construction, any government-supported project-related debt could be refinanced on commercial terms based on the ownership and cash-flow characteristics of the new nuclear asset.

Some rough numbers illustrate the economics of such a new project financing model. Based on an analysis

prepared by MIT’s Center for Advanced Nuclear Energy Systems,91 it is estimated that the next 1.1 gigawatt

AP1000 could be constructed for an overnight capital cost (i.e., construction costs excluding financing) of roughly $5,600 per kilowatt. This estimated unit cost would adjust for all nonrecurring Vogtle-specific expense factors and assume only modest (if any) incremental change orders throughout the building process and final completion of the project within five years. Based on an 80/20 project financing split with an average cost of debt of 5% and a targeted equity internal rate of return (IRR) of 20% for the infrastructure fund sponsor, such a nuclear project could be delivered within five years for the equivalent of $7,500 per kilowatt, including financing costs.

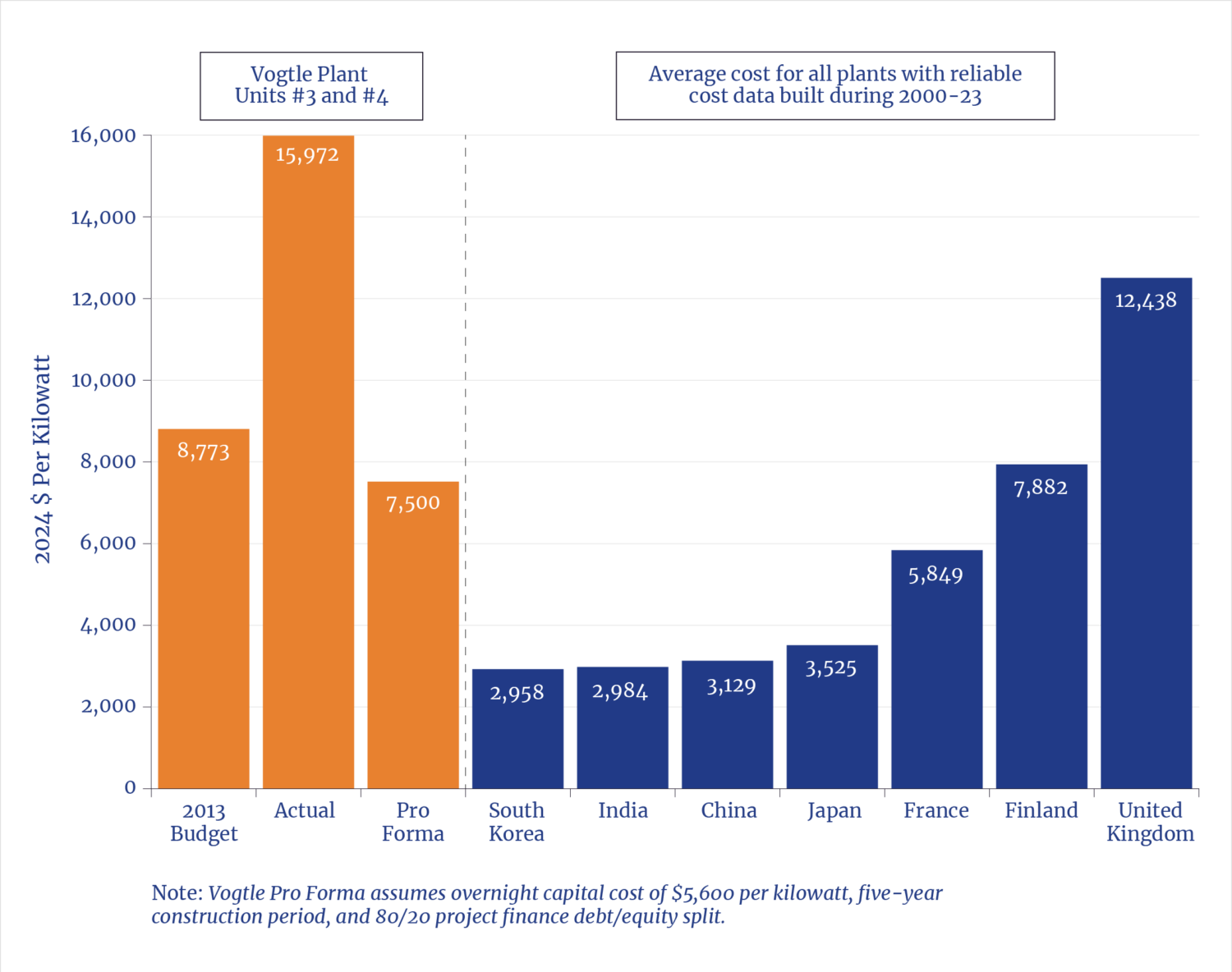

Notably, such a $7,500 per kilowatt estimate would be roughly in line with the inflation-adjusted original

budget prepared for Vogtle and comparable with the performance of other countries with established commercial nuclear programs, as seen in Figure 9. In contrast to the U.S., nations such as South Korea and

China have succeeded in growing their domestic nuclear industries over the last few decades, using a combination of design standardization, manufacturing and construction repetition, and strong government support (particularly financial). As a result, these countries have been able to add new large-scale nuclear capacity for a lower average unit cost, typically over a shorter period of time.

Figure 9: Comparative Nuclear Construction Costs by Country

In turn, as shown in Figure 10, a realized total capital cost of $7,500 per kilowatt for the next AP1000 would

translate into a more competitive LCOE when compared with other dispatchable technologies, including natural gas. Based on LCOE estimates prepared by Lazard,92 MIT,93 and the National Renewable Energy Laboratory,94 the adjusted LCOE for a new AP1000 reactor would approximate $100 per megawatt-hour using the same assumptions for overnight capital costs, completion time, and financing method. This compares with an estimated $169 per megawatt-hour for Vogtle’s two new units on an actual basis and a $79–$200 per megawatthour 2025 range for dispatchable natural gas, coal, and geothermal alternatives, as well as utility-scale solar and wind projects adjusted for the cost of backup battery storage.95 Notably, such LCOE estimates do not capture the full benefits of nuclear power over its much longer operating life. Once capital costs are recouped— typically, after an assumed 30-year repayment period— the marginal cost of nuclear drops substantially due to its low production costs. Lazard currently estimates the backend LCOE for U.S. nuclear in the range of $30–$38 per megawatt-hour.96

Figure 10: Pro Forma Levelized Cost of Energy (LCOE) for the Next AP1000 Reactor

of Next AP1000”; DOE, “Pathways to Commercial Liftoff”

Recommendations and Concluding Remarks

Shortening the U.S. nuclear building cycle while switching to a project finance approach should be enough

to allow new large nuclear reactors to stand on their own economic feet without the need for government

subsidization. Although nuclear power is a dispatchable source of reliable carbon-free electricity, extending

the various clean energy investment and production tax credits that have been used to promote new renewable wind and solar power capacity to nuclear would not appear necessary or advisable. While there is a need for continued government credit support for nuclear power in the form of low-cost loans and loan guarantees (all of which would be repaid upon completion), this requirement should fall away over time as more private lending channels are put into place for nuclear project financing deals. The federal government’s goal should be to facilitate a market-driven solution to the current bottlenecks with large-scale nuclear projects rather than compound previous policy errors by simply throwing subsidies (i.e., free money) at the problem and creating further price distortions across the regional U.S. electricity markets. As previously mentioned, the recently passed OBBBA has maintained the previous schedule of investment

and production tax credits for newly constructed nuclear reactors through 2033, followed by a three-year

phasedown. These nuclear tax credits should be allowed to sunset by 2036 and not be extended further.

Attracting a new source of infrastructure private equity capital to kickstart the development of large-scale

nuclear power in America will require a favorable investment backdrop that, in turn, will depend on greater

regulatory certainty during the all-important construction phase. Toward this end, President Trump signed four executive orders in May 2025 to “usher in a nuclear energy renaissance.”97 Using a whole-of-government approach to supporting nuclear energy development, these presidential directives are intended to build on existing federal policies and programs and drive efficiencies in the licensing, siting, and deployment process for new reactors, mainly by instituting significant reforms at NRC, which has been the chief source of construction delays and completion risk for the industry over the past 50 years. The stated objective is “to re-establish the United States as a global leader in nuclear energy”98 by accelerating the deployment of new reactors while remaining agnostic about the choice of technologies between Generation III+ and IV reactors, modular units, and microreactors.

That said, the administration’s ambitious goal of quadrupling U.S. nuclear generation capacity to roughly

400 gigawatts by 2050 will be achieved only if large-scale reactors such as the AP1000 model play a prominent role. Given the diversity of the existing U.S. nuclear fleet, it will take a while before technology concentration risk becomes a national security issue (if ever). Meanwhile, the industry should just focus on building what it knows how to build, which is the AP1000 reactor. While these executive actions will take time to implement since they require rulemakings by all the applicable agencies, the full-throated public support of the Trump White House for the domestic nuclear industry should prove catalytic.

To follow up on these executive orders, the Trump administration should now work with state officials and

all other relevant counterparties (including financial) to build an industry order book for the first five to 10 AP1000 nuclear reactors. This will help ramp up domestic manufacturing capacity, shore up existing

supply chains, and right-size the required workforce for the next decade. In terms of specific sites and projects, there are currently 17 operating nuclear power plants plus four previously retired facilities with sufficient space for an additional 1.1-gigawatt reactor. Many of these sites were previously issued COLs by NRC over the past 20 years before scrapping their plans for expansion.99

As with Vogtle, locating new reactors at existing nuclear sites will leverage established utility operations

while also minimizing ancillary transmission requirements. In addition, there are 72 currently operating

coal plants, plus 12 recently retired coal-fired facilities that would have backfit potential for a 1.1-gigawatt

nuclear unit.100 Fast-tracking the approval of a short list of nuclear project sites (preferably in regulated state markets) should be a Trump priority. In addition, any unspent LPO funds previously earmarked for unproven clean energy technologies such as hydrogen and carbon capture and sequestration should be reallocated to conventional nuclear development projects. After proof of concept has been demonstrated—that a large AP1000 project sponsored by an infrastructure investment firm and financed on a stand-alone project basis can be completed on time and on budget—such success should feed on itself, allowing the U.S. government to step back and take a less active role as the private financial markets take over.

Endnotes

- Cloudscene, “Top Markets: United States of America,” accessed June 1, 2025.

- U.S. Dept. of Energy (DOE), “Data Centers and Servers,” accessed June 2, 2025.

- Data Center Knowledge, “Data Center Power: Fueling the Digital Revolution,” accessed June 2, 2025.

- Lawrence Berkeley National Laboratory, “2024 United States Data Center Energy Usage Report,” December 2024.

- U.S. Energy Information Administration (EIA), “Monthly Energy Review, Table 7.1: Electricity Overview,” “Annual Energy Outlook 2025, Table 8: Electricity Supply, Disposition, Prices, and Emissions,” accessed June 2, 2025.

- National Renewable Energy Laboratory, “2023 Standard Scenarios Report: A U.S. Electricity Sector Outlook,” January 2024.

- Ember, “Global Electricity Review 2025,” Apr. 8, 2025, accessed June 3, 2025.

- EIA, “Annual Energy Outlook 2025, Table 9: Electricity Generating Capacity,” accessed June 3, 2025.

- North American Electric Reliability Corporation (NERC), “2024 Long-Term Reliability Assessment,” December 2024.

- Shortly before the systemwide blackout across the Iberian Peninsula on Apr. 25, 2025, Spain’s grid operator, Red Eléctrica, reported that wind and solar had met all the country’s total electricity demand for the first time on Apr. 16, 2025.

- NERC, “2024 Long-Term Reliability Assessment.”

- DOE, “Resource Adequacy Report: Evaluating the Reliability and Security of the United States Electric Grid,” July 2025.

- EIA, “Henry Hub Natural Gas Spot Price,” accessed June 4, 2025.

- EIA, “Preliminary Monthly Electric Generator Inventory, April 2025,” accessed June 4, 2025.

- Eric Wesoff, “The Hottest Trend in Nuclear Power: Reopening Shuttered Plants,” Canary Media, Sept. 30, 2024, accessed June 6, 2025.

- Natura Resources, “Natura Resources Announces Two Advanced Nuclear Deployments in Texas,” Feb. 18, 2025, accessed June 5, 2025.

- Raghav Agnihotri et al., “One Big Beautiful Bill Act Cuts the Power: Phase-Outs, Foreign-Entity Restrictions, and Domestic Content in Clean-Energy Credits,” Frost Brown Todd, July 4, 2025.

- EIA, “The United States Operates the World’s Largest Nuclear Power Plant Fleet,” Apr. 24, 2025, accessed June 5, 2025.

- Nuclear Energy Institute, “U.S. Nuclear Plants,” accessed June 6, 2025.

- Our World in Data, “Nuclear Power Generation by Country,” accessed June 6, 2025.

- Our World in Data, “Electricity Production by Source, United States,” accessed June 6, 2025.

- EIA, “Monthly Energy Review, Table 7.7b: Electric Net Summer Capacity: Electric Power Sector,” accessed June 3, 2025.

- EIA, “Electric Power Monthly, Table 6.07.B: Capacity Factors for Utility Scale Generators Primarily Using Non-Fossil Fuels,” accessed June 4, 2025.

- DOE, “The Ultimate Fast Facts Guide to Nuclear Energy,” accessed July 9, 2025.

- DOE, “Pathways to Commercial Liftoff: Advanced Nuclear,” September 2024.

- EIA, “Preliminary Monthly Electric Generator Inventory, December 2024,” accessed June 5, 2025.

- The U.S. Nuclear Regulatory Commission (NRC) licenses new commercial nuclear reactors to operate for an initial 40 years. Prior to the expiration of the original license, licensees can apply for up to two 20-year operating license extensions, for a total of 80 years of operational life.

- EIA, “Preliminary Monthly Electric Generator Inventory, December 2024,” accessed June 5, 2025.

- On Mar. 28, 1979, a cooling malfunction at Unit #2 of the Three Mile Island nuclear generating station caused a partial core meltdown, destroying the reactor. Some radioactive gas was released in the days after the accident as the operating team worked to contain the issue, although not enough to cause any doses above background levels to local residents. Although there were no injuries or adverse public health effects, the negative news coverage was sufficient to turn public opinion against the industry and trigger an overreaction by regulators due to safety concerns.

- World Nuclear Association, “Nuclear Reactors in United States of America,” accessed June 10, 2025.

- In 1989, NRC combined a nuclear construction permit and operating license into one application under Part 52 of Title 10 of the Code of Federal Regulations. To further streamline the process, the agency also approved and certified several standard nuclear plant designs (including the Generation III+ Westinghouse AP1000 model) through a rulemaking.

- The Energy Policy Act of 2005 signed into law by President George W. Bush provided various financial incentives for new nuclear plant construction projects, including loan guarantees, cost overrun support, and the extension of liability protection through 2025 under the Price-Anderson Nuclear Industry Indemnities Act (1957).

- Peter A. Bradford, “Delivering the Nuclear Promise: TVA’s Sale of the Bellefonte Nuclear Power Plant Site,” Bulletin of the Atomic Scientists, June 1, 2016, accessed June 4, 2025.

- World Nuclear Association, “Reactor Database, United States of America, Watts Bar 2,” accessed June 5, 2025.

- World Nuclear Association, “Reactor Database, United States of America, Vogtle 3 and Vogtle 4,” accessed June 5, 2025.

- Given the passage of time since Units #1 and #2 were originally brought online during the late 1980s and the changes in technology and regulations over the intervening years, it is more accurate to refer to the recently completed Units #3 and #4 at the Vogtle Plant site near Waynesboro, Georgia, as greenfield (rather than brownfield) construction projects.

- EIA, “Preliminary Monthly Electric Generator Inventory, December 2024,” accessed June 5, 2025.

- Lazard, “Levelized Cost of Energy+ (LCOE+), June 2025.”

- Federal Reserve Bank of Minneapolis, “Consumer Price Index 1913–,” accessed June 7, 2025.

- EIA, “Nuclear Power Plant Construction Activity, 1988,” “State Nuclear Profiles,” accessed June 8, 2025. Historical costs converted into 2024 dollars using U.S. Bureau of Labor Statistics CPI Inflation Calculator.

- Ibid.

- EIA, “Capital Cost and Performance Characteristics for Utility-Scale Electric Power Generating Technologies,” Jan. 10, 2024.

- Westinghouse, “AP1000 Pressurized Water Reactor,” accessed June 9, 2025.

- Rod Adams, “NRC’s Imposition of Aircraft Impact Rule Played a Major Role in Vogtle Project Delays and VC Summer Failure,” Atomic Insights, Feb. 24, 2023.

- DOE, “Pathways to Commercial Liftoff.”

- Westinghouse, “Shaping Tomorrow’s Energy,” accessed June 8, 2025.

- Edward Shyloski, “What Went Wrong on the Westinghouse Nuclear Projects,” Engineering News-Record, May 1, 2017, accessed June 7, 2025.

- Tom Hals and Emily Flitter, “How Two Cutting Edge U.S. Nuclear Projects Bankrupted Westinghouse,” Reuters, May 2, 2017, accessed June 7, 2025.

- World Nuclear News, “Toshiba Settles VC Summer Guarantee Obligation,” Jan. 12, 2018, accessed June 10, 2025.

- World Nuclear Industry Status Report, “Utilities Abandon V.C. Summer AP1000 Reactor Construction Following Westinghouse Bankruptcy,” Aug. 1, 2017.

- Peg Brickley, “Georgia Power Wants to Press Ahead with Nuclear Plant Despite Rising Costs,” Wall Street Journal, Aug. 31, 2017.

- Dave Williams, “Georgia Power Hit with Second Lawsuit over Plant Vogtle,” The Current, June 24, 2022.

- Both Georgia and South Carolina are regulated electricity markets where all utility capital spending must be approved for rate recovery by public service commissions. Georgia Power began recovering construction costs for Vogtle Units #3 and #4 through a monthly customer surcharge implemented in 2011, while South Carolina Electric & Gas Company customers have been paying for Summer Units #2 and #3 since 2009 and will continue to do so through at least 2032, even though the project was abandoned in 2017.

- DOE, “Pathways to Commercial Liftoff.”

- NRC, “List of Issued Amendments, Exemptions, and Code Alternatives for Vogtle Generating Plant Units 3 and 4,” accessed June 8, 2025.

- DOE, “Pathways to Commercial Liftoff.” 57 Ibid.

- EIA, “U.S. Nuclear Generation and Generating Capacity by State and Reactor,” accessed June 13, 2025.

- EIA, “Electric Power Monthly, Table 6.07.B: Capacity Factors for Utility Scale Generators Primarily Using Non-Fossil Fuels,” accessed June 4, 2025.

- Aaron Larson, “Plant Vogtle Units 3 and 4 Win POWER’s Plant of the Year Award,” POWER, July 1, 2024.

- As noted in the public remarks of Georgia Power Company Chairman, President, and CEO Kimberly Green at the second annual Energy Future Forum, Washington, DC, May 19, 2025.

- World Nuclear Association, “Financing Nuclear Energy,” accessed June 10, 2025.

- Fitch Ratings, “Fitch Downgrades Georgia Power’s IDR; Places on Negative Watch,” Aug. 9, 2018.

- Stanley Dunlap, “State Regulators Pass Along $7.6B Tab to Ratepayers for Georgia Power’s Plant Vogtle,” Georgia Recorder, Dec. 19, 2023.

- Southern Company, “Southern Company Closes Sale of Gulf Power to NextEra Energy,” Jan. 1, 2019.

- Gavin Bade, “Dominion, SCANA Agree to $14.6B All-Stock Merger,” Utility Dive, Jan. 3, 2018.

- U.S. Attorney’s Office, District of South Carolina, “Fourth and Final V.C. Summer Executive Sentenced for Misconduct in Connection with Failed Nuclear Construction Project,” Nov. 21, 2024.

- SEC v. SCANA Corporation, et al., Sept. 3, 2024.

- Tanita Gaither, “SCANA, SCE&G Settles $2 Billion Class-Action Lawsuit in Failed V.C. Summer Project,” WIStv.com, Nov. 26, 2018.

- Peter Maloney, “Santee Cooper CEO Resigns in Wake of Abandonment of Summer Nuclear Project,” Utility Dive, Aug. 28, 2017.

- Jessica Holdman, “Here’s How Much SC Power Customers Are Still Paying for a Failed Nuclear Project,” South Carolina Daily Gazette, Apr. 5, 2024.

- Dan Lowrey, “Underearning Spread Widens for Gas, Electric Utilities in ROE Analysis,” S&P Global, May 29, 2024.

- Boston Consulting Group, “Private Equity Infrastructure Investment Poised for Renewed Growth amid Evolving Market Dynamics,” Mar. 17, 2025, accessed July 9, 2025.

- Wilhelm Schmundt et al., “Infrastructure Strategy 2025: How Investors Can Gain Advantage as the Asset Class Matures,” Boston Consulting Group, March 2025, accessed June 12, 2025.

- Ibid.

- Constellation Energy, “Constellation to Launch Crane Clean Energy Center, Restoring Jobs and Carbon-Free Power to the Grid,” Sept. 20, 2024, accessed June 13, 2025.

- Amazon, “Amazon Signs Agreements for Innovative Nuclear Energy Projects to Address Growing Energy Demands,” Oct. 16, 2024, accessed June 13, 2025.

- Darrell Proctor, “Google Will Fund Three Nuclear Projects with Elementl Power,” POWER, May 7, 2025.

- Pippa Stevens, “Meta Signs Nuclear Power Deal with Constellation Energy,” CNBC, June 3, 2025.

- World Nuclear Association, “Major Global Companies Pledge Historic Support to Triple Nuclear Energy,” Mar. 28, 2025, accessed June 13, 2025.

- All balance-sheet cash figures sourced from latest company 10-Q report filed with the SEC.

- OECD Nuclear Energy Agency, “Unlocking Reductions in the Construction Costs of Nuclear: A Practical Guide for Stakeholders,” 2020.

- DOE, “Pathways to Commercial Liftoff.”

- DOE, “Loan Programs Office: Overview,” accessed June 12, 2025.

- Chirag Lala and Advait Arun, “One Big Beautiful Blackout,” Center for Public Enterprise, June 30, 2025.

- The White House, “What They Are Saying: Senate Approves Landmark One Big Beautiful Bill,” July 1, 2025.

- DOE, “Energy Secretary Wright Testifies Before House Energy Subcommittee on FY2026 Budget Request,” June 10, 2025.

- DOE, “Loan Programs Office: Overview,” accessed June 12, 2025.

- World Nuclear News, “World Bank Ends Ban on Funding Nuclear Energy,” June 12, 2025.

- Assured Guaranty Ltd., “Businesses: Global Infrastructure Finance,” accessed June 15, 2025.

- Koroush Shirvan, “2024 Total Cost Projection of Next AP1000,” MIT Center for Advanced Nuclear Energy Systems, July 2024.

- Lazard, “Levelized Cost of Energy+ (LCOE+), June 2025.”

- Shirvan, “2024 Total Cost Projection of Next AP1000.”

- DOE, “Pathways to Commercial Liftoff.”

- Lazard, “Levelized Cost of Energy+ (LCOE+), June 2025.” 96 Ibid.

- The White House, “President Trump Signs Executive Orders to Usher in a Nuclear Renaissance, Restore Gold Standard Science,” May 23, 2025.

- The White House, “Ordering the Reform of the Nuclear Regulatory Commission,” May 23, 2025.

- DOE, “Evaluation of Nuclear Power Plant and Coal Power Plant Sites for New Nuclear Capacity: Nuclear Fuel Cycle and Supply Chain,” Sept. 3, 2024.

- Ibid.

ABOUT THE AUTHOR

Paul Tice spent 40 years working on Wall Street at some of the industry’s most recognizable firms, including J.P. Morgan, Lehman Brothers, Deutsche Bank/Bankers Trust and BlackRock. For most of his career, he specialized in the energy sector—both as a top-ranked sell-side research analyst and a buy-side investment manager—which has also made him an expert in climate policy and environmental regulation and its financial off-shoot, the ESG and sustainable investment movement. Paul is the author of “The Race to Zero: How ESG Investing Will Crater the Global Financial System.”

Since 2017, he has taught about the energy, infrastructure and project finance markets as an adjunct professor of finance at New York University’s Stern School of Business, and he recently joined the National Center for Energy Analytics in March 2024 as a Senior Fellow and a member of its Board of Advisors. His opinion pieces have appeared in the Wall Street Journal, the Washington Examiner, the New York Post, the Epoch Times, Real Clear Energy and The Hill. Paul holds a BA in English from Columbia University and an MBA in Finance from NYU Stern.